Powering the Future: Navigating the Lithium Triangle's Role in the Global Energy Revolution

The climate crisis has thrown technological development down a new path of sustainable, green innovation. An oil based future will lead only to our demise. As such, society grapples for the next ‘oil’; a new resource that will run the world. Lithium has presented itself as a saving grace, making it one of the world’s most important resources in the development of green technology. Thrusting the Lithium Triangle into a position of great influence.

The Lithium Triangle is a group of countries known for their large lithium reserves. Bolivia, Argentina, and Chile combine for most of the globe's total lithium reserves.

Lithium is a precious metal that has surged in popularity in recent years. The climate crisis has pushed the innovation of green technology powered by lithium-ion batteries. The demand for lithium has made resource-rich regions such as the Lithium Triangle essential to global development.

Holding more than 50% of the world's lithium means the Lithium Triangle is an essential component in humanity's quest to a carbon-neutral society. The resources that lie within the Lithium Triangle are needed for us to solve the climate crisis. On paper, lithium is the holy grail of green technology. However, the truth is that the complexities of associated political agendas, economic strategies and environmental forecasts heavily influence the ability to extract and use the natural resources that lie in the region.

The costs of extracting lithium brines from the triangle's salt flats make developing a lithium production industry difficult. Through foreign partnership and investment, Bolivia, Argentina and Chile can build the foundations of a prosperous lithium-based economy.

Beyond economic costs, lithium extraction poses challenges for over 400 Indigenous populations. Government policies play a crucial role, shaping the interaction between extraction and communities. Local Indigenous groups face a battle for land rights, with a lack of formal titles leading to potential evictions and protests, fueled by suspicions of land appropriation for lithium extraction. As each country navigates plans for bringing prosperity to its name, socio-political and economic complexities are unavoidably part of the package.

The surge in demand for lithium-ion batteries driven by the global shift toward electrification ironically raises environmental concerns regarding lithium extraction. Despite the environmental benefits of lithium in green vehicles, the manufacturing process for electric vehicles currently emits approximately double the greenhouse gases of gas vehicles due to the extraction and sourcing of lithium. The impact of lithium mining on the environment includes significant water depletion in regions like the Lithium Triangle and contamination of water sources, adversely affecting local inhabitants, wildlife, livestock, and farmland. Initiatives at corporate and federal levels are being explored to mitigate the negative environmental effects, but as demand for lithium continues to rise, innovation becomes essential to improve the efficiency and scale of mining activities while minimizing environmental impact.

Looking ahead, the global demand for lithium is projected to rise significantly, quadrupling from 2022 levels, driven by the increasing adoption of electric vehicles and the need for energy storage. However, challenges such as potential supply shortages by 2025, technological innovations, and sustainability practices in lithium extraction are emerging, signaling a complex path for the crucial element's role in a sustainable energy future.

The Triangle’s Lithium Landscape

Lithium is a chemical element that can be found naturally around the world. The element is found naturally as a solid rock buried in the earth's crust or extracted from saline groundwater enriched with lithium. The presence of lithium in a country's natural resources provides enormous developmental opportunities. The popularity of lithium is powered by its growing demand and scarce concentrated supply.

Estimates predict there are 98 million metric tonnes of identified lithium resources worldwide. However, geological evidence has only proved the existence of 26 million tonnes. From the U.S. Geological Survey completed in 2022, estimates indicate that 53% of global lithium resources are found in the Lithium Triangle.

Bolivia holds the most lithium resources globally, with an estimated 21 million metric tonnes. While Bolivia is home to the largest source of lithium in the world, it does not produce the metal due to several environmental, political and economic barriers. However, the country's future of lithium production has been secured. Chinese consortium CBC has invested $1 billion into Bolivian lithium development as part of a deal made in January of 2023. Recently, CBC has extended the agreement, increasing funding by another $90 million dollars.

Much of the Triangle's lithium is trapped in the Uyuni salt flat. Located in Bolivia, the Uyuni salt flat is over 3,900 square feet and is rich in lithium. Bolivia's Chinese partners plan to extract the lithium brine trapped in the flats. However, the dry conditions complicate the extraction; the filtering process takes between 12 and 18 months and is extremely costly. The Uyuni salt flat is a pivotal lithium reserve in the global market. Its lithium supply gives the Lithium Triangle the potential to become a global powerhouse in the industry.

Argentina is second on the list regarding lithium resources, with an estimated 20 million metric tonnes of lithium resources. They are the fourth largest global lithium producer, with two major operations in the Catamarca and Salar de Olaroz mines. Foreign American and Australian firms manage these operations. Argentina has six more operations under development, alongside another 15 still in the pipeline.

Chile takes fourth place when it comes to global lithium resources. Estimates say that the country has 12 million metric tonnes of lithium. While the country has relatively low resources compared to the rest of the Triangle, it is the second largest producer of lithium globally with its two main operations that American and local Chilean firms own.

White Gold: Lithium’s Economics Opportunities

The Lithium Triangle hosts more than half of the globe's lithium. The natural occurrence of lithium creates a rare opportunity for South America to become the global hub of lithium production. Lithium is predominantly used for the production of lithium-ion batteries. These batteries power virtually all electronics, from smartphones to electric vehicles.

Given the variety of practical uses for lithium-ion batteries, the demand for lithium has rapidly increased and analysts expect the market to continue to grow. By 2030, the International Energy Agency predicts that electric vehicles will make up 67% of global car sales. To put that in perspective, in 2022, electric vehicle sales made up only 14% of global purchases. The lithium market is set for an imminent explosion. This presents the Lithium Triangle an excellent opportunity to become a powerhouse in producing and selling lithium.

While all projections point to lithium being the metal of the future, why are countries such as Bolivia, who have high lithium resources, not producing the metal? The reality is that mining lithium mining comes at a high cost. Lithium brine manufacturing costs about twice as much as hard rock mining. One tonne of lithium concentrate produced from brine costs approximately USD 5,580; the same tonne produced from hard rock lithium would only cost USD 2,540. Due to the high production costs, Lithium Triangle countries rely on foreign investment and partnerships to extract and use their lithium resources.

Source: S&P Global Market Intelligence

The effects of high manufacturing costs are evident when we look at the current landscape of the lithium production market. Australia currently produces most of the world's lithium despite having fewer resources than any country in the Lithium Triangle. This is because Australia's lithium resources are predominantly made up of hard rock reserves, simplifying the manufacturing process and allowing them to produce the metal at lower costs.

The Lithium Triangle can solve its high manufacturing cost problem through foreign investment. As mentioned previously, Argentina and Chile both operate lithium mines that are run by foreign parties. Bolivia has also worked out an agreement with Chinese investors. While, in theory, partnerships are the ideal solution to the problem of high costs, in reality, they are rarely mutually beneficial. In the Lithium Triangle specifically, this foreign exploitation has been an issue.

In 2019, ACI Systems partnered with the Bolivian government for industrial use of lithium in exchange for $1.3 billion in mining investment and promised jobs to Bolivian citizens. The partnership was short-lived as the jobs given to Bolivians were scarce and only included low-paying unskilled labour. Similarly, In Argentina, Minera Exar agreed with local indigenous communities to use their land for lithium mining in exchange for annual royalties. However, local testimonies found that mining firms fell through on their end of the agreement, and the residents were being exploited without compensation.

A successful partnership is one where all parties are treated fairly. Partnerships can be incredibly effective if appropriate regulations are implemented and all parties are held accountable for their portion of the agreement. The Lithium Triangle needs to emphasize three critical objectives during negotiations to reach an equitable agreement: value chain retention, domestic infrastructure, and local labour.

Value Chain Retention

Lithium's profitability is derived from its extensive value chain. From extraction to final product, it goes through multiple processes to be usable. To maximize profits, countries in the Lithium Triangle need to emphasize domestically producing as much of the final product as possible. South American countries can leverage foreign investment dollars to secure production infrastructure and push demand for South American produced lithium. Transforming the Lithium Triangle into a global hub for the entire production process.

Domestic Infrastructure

Domestic firm involvement needs to be top priority during negotiations. Promoting local industry is essential for when the partnership ends. Developing domestic lithium production ensures that the sector is self-sufficient and that Lithium Triangle countries are not dependent on foreign parties. This key initiative is pivotal in developing a sustainable South American lithium industry in the long term.

Local Labour

Local labour must also be a priority for Lithium Triangle countries. Through independent and on-the-job training, local workers can develop the skills to do meaningful work in the industry. The local labour initiative promotes education and the overall standard of living in local communities. Furthermore, an emphasis on local workers will promote local businesses as households will have a secure source of income, increasing community welfare.

With foreign investment, the Lithium Triangle can take advantage of its wealth of natural resources. Partnerships with other developed countries are necessary to build and stabilize the lithium industry in South America. Given a history of exploitation, value chain retention, domestic firm involvement and local labour must be key areas of negotiation to establish a partnership. These objectives focus on developing local economies and communities and protecting the Triangle's ability to independently produce lithium without relying on foreign infrastructure.

Lithium Mining’s Environmental Challenges

As the demand for lithium-ion batteries skyrockets in tandem with the global push towards electrification, the environmental impact of lithium extraction has come under increased scrutiny.

While it is widely believed (and true) that lithium, and the shift towards ‘green’ vehicles is accompanied by environmental benefits, there is a catch. The manufacturing process for electric vehicles (EVs) currently is associated with greater—approximately double—greenhouse gas (GHG) emissions than gas vehicles (GVs) as depicted in the chart below. While GVs eventually surpass the emissions of EVs at approximately 50,000 kilometres of driving, the more emission-intensive production process is directly related to the sourcing and extraction of lithium.

Source: The ICCT

Source: Policy Options (Adapted from Environmental Life Cycle Assessment of Electric Vehicles in Canada, 2018)

Extracting one tonne of lithium requires about 500,000 gallons of water (almost 2 million litres). For reference, a Tesla Model S’s battery contains around 12 kilograms of lithium. This equates to ~6000 gallons of water just for the lithium used in one electric sedan. This has not only been detrimental to the environment over recent years but will likely continue to negatively affect the environment; should demand for lithium continue to rise as is expected with a surge in EV production and sales, the environmental impacts and consequences may amount to the loss of human lives.

The impact of lithium mining can be seen on the environment in largely two ways: firstly, through water depletion within the Lithium Triangle’s region, and secondly, contamination of water sources, consequently damaging wildlife/livestock and farmland. The process of extracting lithium often involves drilling holes in salt flats to pull lithium-rich brine from underground reservoirs. This intensive use of water exacerbates the already existing water scarcity issues in the arid region, which is one of the driest places on earth. The depletion of aquifers and surface water reservoirs can have far-reaching consequences on the overall well-being of the region. For example, in Salar de Atacama in Chile, it was reported that 65% of the region’s water had been used/evaporated as a result of lithium mining.

The contamination of water sources further compounds the environmental impact. The chemicals and by-products generated during lithium extraction can leach into nearby water bodies, affecting the quality of water. This contamination not only poses a direct threat to the health of local wildlife but also jeopardizes the safety of water supplies for both livestock and agricultural activities. As water plays a pivotal role in sustaining life and livelihoods in these areas, any compromise in its quality can have cascading effects on the entire ecosystem, including the flora and fauna that depend on these water sources.

The risks of water depletion and contamination create especially difficult conditions for farmers who rely on their crops and livelihood to sustain a livelihood. In a clip uploaded to Vimeo, Gil Cruz, a weaver from Santa Cruz, says, “The day I run out of llamas, I don’t know what I’ll live on, what I’ll feed my children. If the water runs out, life will disappear. What will our cattle live on if there’s no water left? The mining companies think of today’s bread, but not tomorrow’s. We are worried about the future of our children and grandchildren.”

A study published by the Proceedings of the Royal Society B in 2022 found that in Salar de Atacama, the largest salt flat in Chile, and a lithium hotspot, “mining was negatively correlated with the abundance of two of the three flamingo species” in the region. Given the vulnerable status of Andean, James’ and Chilean flamingos and their importance for the region as an ecotourism attraction, a decrease in surface water as a result of an increase in mining can further drop flamingo populations and lead to long-term ramifications for the ecosystem and community.

In order to mitigate and reduce some of the negative environmental effects associated with lithium mining, several initiatives are currently being explored, both at the corporate and federal level. With demand for lithium continuously rising, investment is also expected to grow by $7 billion each year until 2028 in order to meet global demand, according to Benchmark Mineral Intelligence. As more dollars are poured into the industry, innovation aimed at improving the efficiency and scale of mining activities while simultaneously reducing environmental impacts are likely to be an emerging priority.

Source: Wetlands International

Socio-Political Dynamics within the Lithium Triangle

The vast lithium resources concentrated in the Lithium Triangle have become a focal point for economic development. However, the extraction of lithium in these areas has significant implications for local communities and the over 400 Indigenous populations inhabiting the region. Government policies and regulations play a pivotal role in shaping the interaction between lithium extraction and local communities. The socio-cultural fabric of these communities is intricately tied to the land, making it crucial to consider their interests and well-being amidst the boom of lithium mining activities.

A major challenge faced by the local Indigenous groups, beyond the environmental threats to their livelihood, is the battle resulting from a lack of formal titles and rights to the land on which they live. Nati Machaca, a spokesperson for the Indigenous people in Jujuy, Argentina, shares how she received the land from her grandfather who purchased it from a landowner generations ago. "Back then it was all verbal agreements," she explains, "but there's no proof". Following a constitutional reform brought about by Gerardo Morales, the governor of Jujuy, Ms Machaca and those in the same position as her may face eviction as they do not have the necessary legal documents to support their rights to the land. This has led to outrage, controversy and protests within the region, especially as many believe the actions are a ploy to gain access to the land’s lithium and avoid sharing the benefits with the original people of the land.

All three countries of the Lithium Triangle are quickly acting on the opportunities that present themselves with hope of national prosperity, although the approach varies quite significantly across the three nations. Influenced by their unique history, economic conditions, and the political climate, the strategies being employed by the countries range from placing tight restrictions on foreign involvement to a more ‘free-market’ concept that openly welcomes private investment.

Bolivia

Under the presidency of left-wing Evo Morales, Bolivia established a state-controlled lithium firm in 2017, Yacimientos de Litio Bolivianos, aiming to oversee the entire value chain, from extraction to battery production. However, this strategy faced challenges, resulting in limited lithium production despite Bolivia having the world's largest resources. President Luis Arce, who came into power in 2020, seeking to unlock the value of Bolivia’s lithium reserves through international collaboration, confirmed a $1.4 billion agreement in June 2023 with Chinese consortium CBC, comprising battery giant CATL (Contemporary Amperex Technology Co.), CMOC Group and Brunp (Guangdong Brunp Recycling Technology). Hot on the trails of the previous deal, Bolivia also signed agreements with Chinese Citic Guoan Group for a $857 million investment and Russian Uranium One (an entity of Rosatom, a state corporation) for a $600 million investment to further the nation’s goal of accelerating the "era of industrialization of Bolivian lithium" These partnerships aim to build lithium-extraction facilities, addressing technical challenges and positioning Bolivia as a leader in the global lithium market over the years ahead. For now, Bolivia is caught in a game of catch-up.

Argentina

Argentina has jumped at the opportunity that lithium export brings to the nation and, unlike Bolivia, has not shied away from foreign involvement; it now stands at a critical juncture in the global clean energy transition, with its vast lithium reserves thrusting it into a complex socio-political landscape. President Javier Milei's expressed intention to shift Argentina's foreign policy away from China towards the United States introduces potential challenges, given the existing and deep-rooted Chinese investments in the country's lithium sector. This strategic shift could strain Argentina's economic ties, particularly considering that ~40% of its lithium export sales is to China. However, Milei's influence within the federal government may be limited, and potential conflicts of interest with provincial governors (who each have local lithium under their own jurisdiction), who host Chinese-backed lithium mines, add layers of complexity to the decision-making process.

The socio-political implications extend beyond economic considerations, influencing Argentina's position in regional alliances within the Global South. While aligning with the United States may promise economic revitalization through access to the North American EV market, uncertainties surrounding criteria like the US Inflation Reduction Act and the country's internal economic challenges make the decision fraught with complexities. This pivotal moment not only shapes Argentina's economic future but also has broader ramifications, potentially impacting the geopolitics of lithium-rich nations and reshaping regional dynamics in the ongoing global transition to clean energy. Argentina seems to be ‘betting big’ and is expected to pass Chile as the region’s largest lithium producer by 2030.

Chile

Chile, with the world's largest lithium reserves and a major supplier to the US, announced in April 2023 its intent to nationalize its lithium reserves, led by leftist President Gabriel Boric. The move, resembling a strategy similar to its northern neighbour, is expected to come with its own share of socio-political implications. Boric justifies this move with economic, social, and environmental considerations, framing it as a part of a global trend of greenwashed protectionist policies around Rare Earth Elements (REEs). Currently, only two companies are mining lithium in Chile—and both are private. Going forward, as part of Chile’s strategic plan, lithium contracts will be public-private partnerships with the aim of employing state oversight to ensure sustainable growth in lithium production while protecting biodiversity of the salt flats.

The nationalization plan, while gradual and involving compensation to investors—as well as up to 3.5% of sales to local Indigenous communities—also poses potential economic clashes between supplying and demanding nations and may lead to the emergence of an "REE OPEC." Currently, Boric's vision includes leveraging nationalized lithium for profit and embracing the Direct Lithium Extraction (DLE) process, signaling a broader shift in global resource dynamics that could impact the energy, electronics, and EV markets, as well as national security. Chile stands on malleable ground in the context of the future of the Lithium Triangle and may unsurprisingly take a slight backseat in the lithium race in favour of a community- and environment-first approach.

Navigating Global Demand & Charging the Future

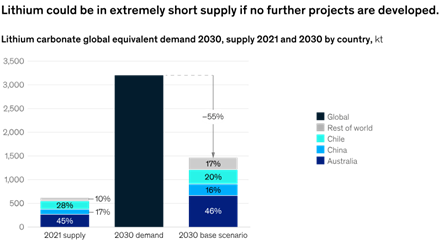

Looking ahead towards 2030, the demand for lithium is expected to continue its upward trajectory. Global lithium demand was 720,000 tons of LCE (lithium carbonate equivalent) in 2022 and is forecasted to grow to 1,760,000 tons in 2026 and 3,060,000 tons in 2030, increasing by 20% annually. This trend, spurred by the growing adoption of EVs and the increasing need for energy storage solutions, is likely to lead to further investments in lithium extraction and processing capabilities in the Lithium Triangle, alongside a push for technological innovations to improve the efficiency and sustainability of lithium production. Moreover, geopolitical factors and trade policies will significantly influence the global lithium market, as countries seek to secure stable and sustainable lithium supplies.

While surging demand is a positive sign for production economies such as those within the Lithium Triangle, a very realistic challenge exists in harbouring facilities that can meet the rising demand. According to a report by BMI Research, a part of Fitch Solutions, global lithium supply is predicted to fall short of demand as early as 2025. At the core of this forecast is China, the world’s third largest lithium producer and whose year-on-year annual demand growth is believed to outstrip its supply growth 20.4% to 6%. While many analysts agree with the likelihood of a supply shortage, mixed opinions exist over timelines. Rystad Energy, an energy research and business intelligence company, proposes that new mines and projects will aid in meeting demand over the short-term, but will merely push the predicted supply-demand deficit towards the end of the decade. A 2023 McKinsey report states that in order to meet global LCE demand, “the world will need to bring an additional 1.42 million metric tons of LCE of annual capacity online above planned and probable projects.” The implications of a shortage would be significant, driving lithium prices up, bottlenecking/delaying manufacturing activities and amplifying the battle between companies vying for the element. Even in the event that adequate global supply is achieved, trade arrangements and supply chain constraints will inevitably translate to hurdles in accessing lithium at regional levels.

Source: McKinsey MineSpans (2022)

In response to the growing global demand for lithium, the mining industry is witnessing a wave of innovative technologies and practices that aim to meet this demand sustainably. DLE is a revolutionary technique that minimizes the environmental impact of traditional lithium extraction methods. DLE involves selectively extracting lithium from brine using specialized sorbents, reducing water consumption and speeding up the production process. Another cutting-edge approach is Selective Lithium Adsorption, which employs advanced materials to selectively capture lithium ions, offering a more efficient and environmentally friendly alternative to conventional methods. Additionally, recycling initiatives are gaining traction as a means of supplementing the lithium supply. Recycling lithium-ion batteries, through either a heat-based smelting process or liquid-based leaching process, not only reduces the environmental footprint but also helps meet the escalating global demand for lithium. Investment in research & development and innovation to increase production of lithium—as well as enhance its lifespan and potential reusability—will be crucial in the transition towards a more sustainable energy future.

There is no doubt that lithium has established itself as a critical element to the current and future operations of our world. As such an essential, highly demanded yet finite resource, it bears a slight resemblance to oil. However, as oil inches closer to being ‘out’ and lithium makes its way ‘in,’ questions arise over whether lithium is here to stay or another stepping stone in the journey to a fully-sustainable world. While the answer is not yet clear, one thing remains certain: the journey for lithium has a rocky road ahead.